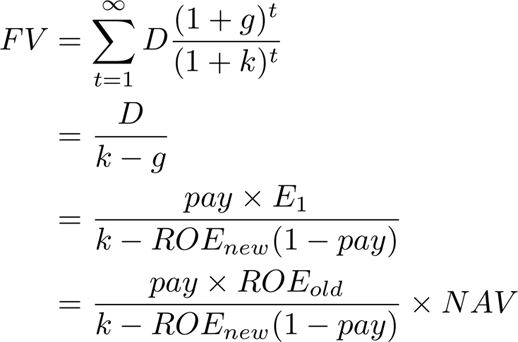

Value investing is predicated on finding companies that are underpriced given their fundamental value (FV). In a dividend discount model, the FV of a firm is equivalent to the sum of its future dividends. So, if a firm is trading below its FV with a margin of safety, it's worth investing.

Ways of assessing FV:

ROE_old = Old return on equity

ROE_new = New return on equity

k = Cost of capital

- Net asset value (balance sheet). Assuming

ROE_old = ROE_new = k, the only value is in the firm's assets. So, you should push to have the firm liquidated. - Earnings power value (income statement). When

ROE_new = k, you assume that the company won't create any new offerings. - Growth value (value from future NPV positive projects). If

ROE_new > k, the FV is equal to the earnings power value and the present value of growth opportunities.

For further derivation: